24++ How Do I File Previous Years Taxes With Hr Block download

How do i file previous years taxes with hr block. Create a folder on drive X. All tax situations are different and not everyone gets a refund. The Import your personal and tax data from last years return page opens. Press Go on the new computer to start the transfer. Use a prior-year version of H. How do I find my IP PIN. I file through a different accountant this year and. Are there fines or penalties for late or past year tax returns. Under the Review your PDF tax summary click the View link next to the return you want to see. If you just want to transfer everything you dont need to go to the Advanced menu. Selecting the year will display your filing information and tax. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.

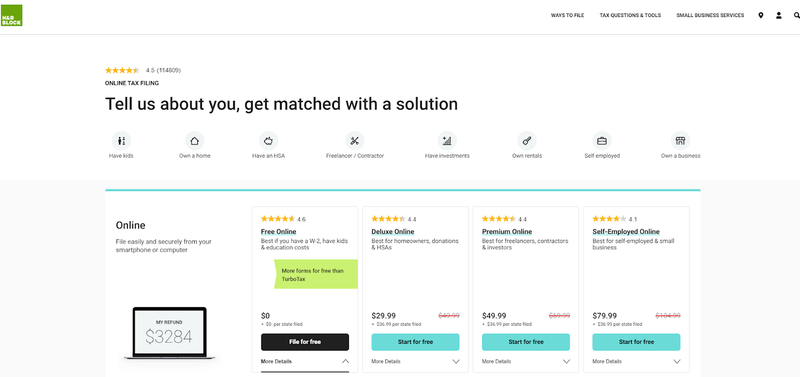

For more assistance with filing previous years taxes get help from HR Block. Dont select Continue as transferring is only available on new empty returns. Navigate to the location that you created in Step 1. You can use the drop-down menu on top to select the tax year for which you need to find the HR block copy of the tax return. How do i file previous years taxes with hr block However you can file prior-year returns in either of these two ways. Only available for returns not prepared by HR Block. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Complete your tax returns accurately. A tax year is from January 1 - December 31 for any given year. I filed with hr block last year and cannot file this year without my pin Accountants Assistant. What have you tried with HR Block so far. The Australian Taxation Office ATO may apply a. But your specific facts and IRS rules will determine how far back you should file.

H R Block Review 2021 Pros And Cons

How do i file previous years taxes with hr block HR Block will be transferred automatically.

How do i file previous years taxes with hr block. Called HRB 20YY Backup change YY to the actual year of the software Open your return. I havent tried anything through hr block this year. Take a look at the article below.

Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. Click the Transfer Return button on the Good News. Go to HR Blocks home page.

If you want to file those prior-year returns you cant do it using HR Block Online. Complete the return and submit it to the appropriate IRS unit. If you have several past-due returns to file the IRS normally requires that you file returns for the current year and past six years.

Repeat steps 2-5 for all remaining returns. Taxpayers can complete and mail Form 4506 to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form. Click on the Prior Years link in the upper right corner.

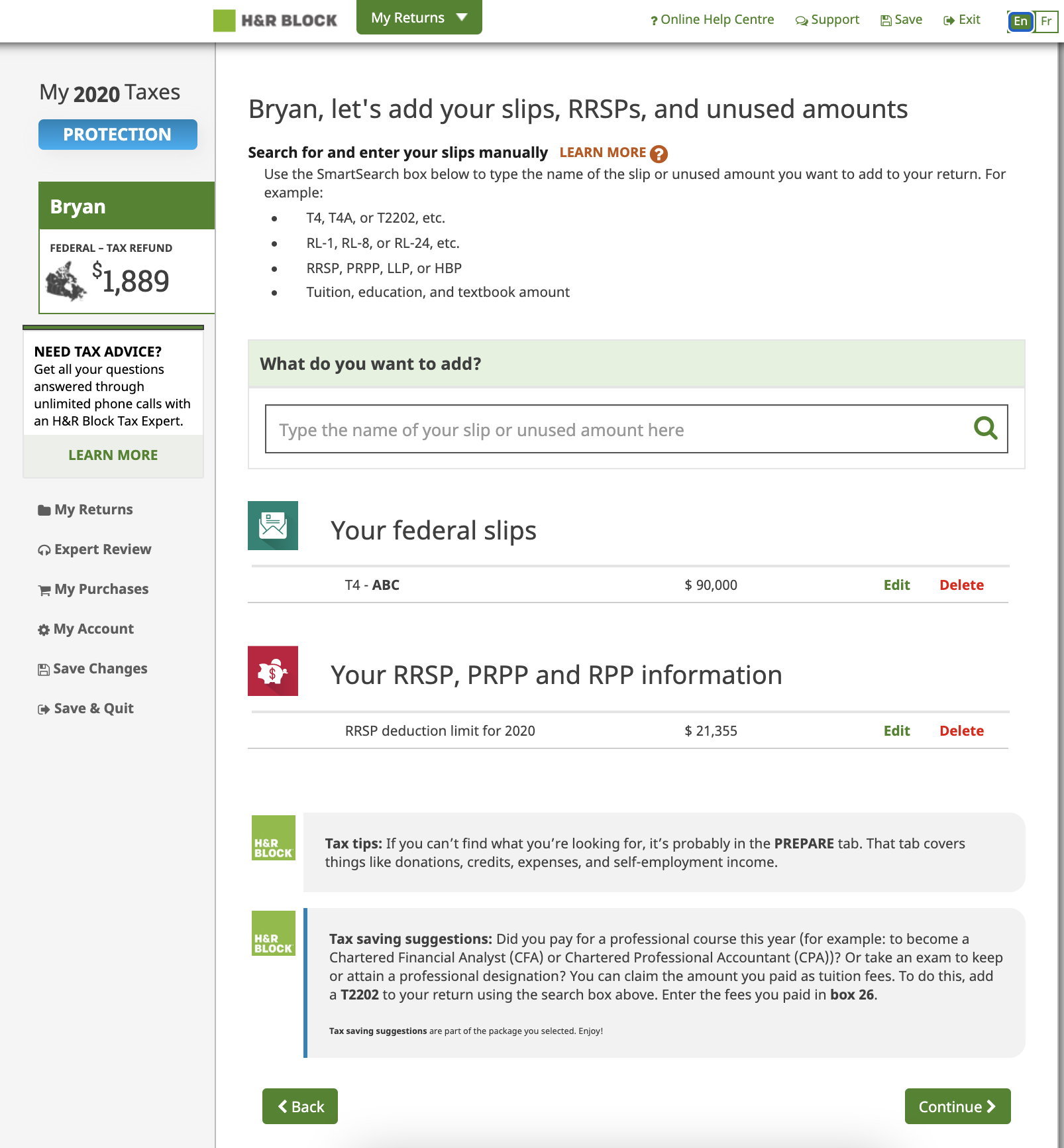

Getting Your Returns from HR Block. In certain cases we work interactively with taxpayers and our CPA can prepare your previous year tax return with you. Click File Backup Return.

How to import my last years tax return in HR Block file to Turbotax. Provided youre using the same sign in information as last year your information will automatically be imported into your 2016 return. There is a link for instructions about how to import your prior year return from other companies into TurboTax.

Transferring from TurboTax for Windows HR Block or TaxACT. The fee per copy is 50. I note that the three past answers all make the assumption that the writer is in the USA.

Click on the Sign In link in the navigation bar at the top of the screen. Just use one of these procedures. Select HR Block Online and click Next.

Just call 13 23 25 or find your nearest office today and book an appointment. If you need information from a prior year tax return use Get Transcript to request a return or account transcript. More Help With Filing Previous Years Taxes.

You can get copies of your returns from HR Block directly or from the IRS. HR Block Tax Accountants can help you with your outstanding tax returns for this and past years. Follow these steps to back up your HR Block Business data on the Windows 7 machine.

H R Block is also present in Australia as an Income Tax Preparation Tax Agent Company Accountancy practice with multiple sites across Australia Franchi. Once youve logged in to your MyBlock account look for the Taxes menu and select the Tax History option. Launch TurboTax 2019 and click Start a New Return or go to File in the upper left corner and select New Tax Return.

A summary of your tax return downloads to your computer as a PDF file. If youd like to select which applications and files you want to transfer press the Advanced menu. Talk to a tax professional at one of our office locations nationwide.

Fees apply if you have us file an amended return. A tax season prepare and e-file returns for the previous calendar or tax year is from January 1 until October 15 of any current year. Sign in to your HR Block account.

Under the WRAP-UP tab scroll to the bottom of the SUMMARY page.

How do i file previous years taxes with hr block Under the WRAP-UP tab scroll to the bottom of the SUMMARY page.

How do i file previous years taxes with hr block. Sign in to your HR Block account. A tax season prepare and e-file returns for the previous calendar or tax year is from January 1 until October 15 of any current year. Fees apply if you have us file an amended return. Talk to a tax professional at one of our office locations nationwide. If youd like to select which applications and files you want to transfer press the Advanced menu. A summary of your tax return downloads to your computer as a PDF file. Launch TurboTax 2019 and click Start a New Return or go to File in the upper left corner and select New Tax Return. Once youve logged in to your MyBlock account look for the Taxes menu and select the Tax History option. H R Block is also present in Australia as an Income Tax Preparation Tax Agent Company Accountancy practice with multiple sites across Australia Franchi. Follow these steps to back up your HR Block Business data on the Windows 7 machine. HR Block Tax Accountants can help you with your outstanding tax returns for this and past years.

You can get copies of your returns from HR Block directly or from the IRS. More Help With Filing Previous Years Taxes. How do i file previous years taxes with hr block If you need information from a prior year tax return use Get Transcript to request a return or account transcript. Just call 13 23 25 or find your nearest office today and book an appointment. Select HR Block Online and click Next. Just use one of these procedures. Click on the Sign In link in the navigation bar at the top of the screen. I note that the three past answers all make the assumption that the writer is in the USA. The fee per copy is 50. Transferring from TurboTax for Windows HR Block or TaxACT. There is a link for instructions about how to import your prior year return from other companies into TurboTax.

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

Provided youre using the same sign in information as last year your information will automatically be imported into your 2016 return. How to import my last years tax return in HR Block file to Turbotax. Click File Backup Return. In certain cases we work interactively with taxpayers and our CPA can prepare your previous year tax return with you. Getting Your Returns from HR Block. Click on the Prior Years link in the upper right corner. Taxpayers can complete and mail Form 4506 to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form. Repeat steps 2-5 for all remaining returns. If you have several past-due returns to file the IRS normally requires that you file returns for the current year and past six years. Complete the return and submit it to the appropriate IRS unit. If you want to file those prior-year returns you cant do it using HR Block Online. Go to HR Blocks home page. How do i file previous years taxes with hr block.