46+ Does A Revocable Trust Protect Your Assets From Nursing Homes Download

Does a revocable trust protect your assets from nursing homes. A revocable trust is great for many reasons but it does NOT protect assets from nursing home expenses. So after about an hour of some rather in-depth discussion and education they asked me to help them set up a new kind of trust - one that would give them protection if they go into a nursing home at least five years from now. You can maintain control over your finances but remove your assets from your name. A revocable living trust will not protect your assets from a nursing home. It would be an irrevocable trust. And you have absolute control over any assets held by the trust. You can protect assets no matter how long you have been in a nursing home. Assets in an irrevocable trust are not owned in your name and therefore are not part of the probated estate. Regardless of when you create your living trust in relation to when you need care assets inside revocable living trusts are generally treated as available assets for Medicaid purposes. The assets in the revocable trusts will also still count when determining if you can qualify for Medicaid. A living trust provides the security you need. Compare this with a revocable or living trust which offers no asset protection for Medicaid purposes because the government considers the assets in a revocable trust to still be your property.

My answer was Not a chance All assets in a revocable living trust must be spent if the person who set up the trust enters a nursing home. I Can Protect My Assets From a Nursing Home with a Revocable Trust. Nursing Home Asset Protection Trusts To qualify for Medicaid people often give assets to their loved ones. This is because the assets in a revocable trust are still under the control of the owner. Does a revocable trust protect your assets from nursing homes Property that you leave to others via a revocable trust does not need the approval of probate courts before it. Can target the assets in the living revocable trust. Of course you could give direct gifts but you could also convey assets into a Medicaid trust. Trusts are the preferred way to protect assets but the types of trusts that are used for this purpose are irrevocable trusts that hold assets you have given away. Unlike living trusts irrevocable trusts contain assets that are often exempt from nursing home costs. When the government looks at your ability to pay for nursing home costs theyll find little or none because everything resides in the living trust. Although similar to an Income Only Trust a Revocable Trust will not protect assets from the nursing home in most situations because the creator of the trust retains the right to revoke the trust and thus can receive the assets back from the trust. However there are certain drawbacks to consider. A Medicaid trust would not be a revocable trust.

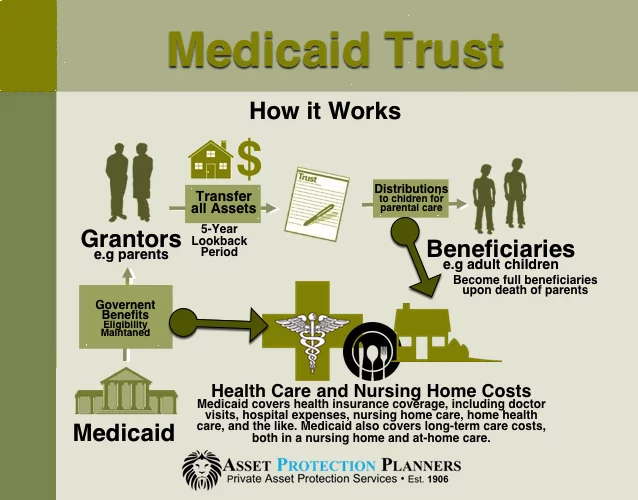

Medicaid Trust For Asset Protection From Nursing Home Costs

Medicaid Trust For Asset Protection From Nursing Home Costs

Does a revocable trust protect your assets from nursing homes A revocable trust is an important part of any estate plan that is designed to protect your familys assets from nursing home costs but by itself will not protect your assets.

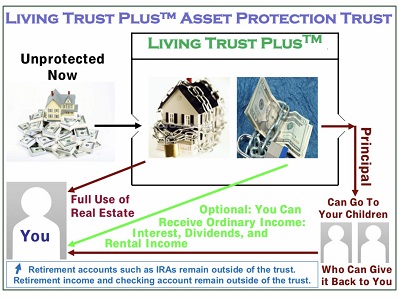

Does a revocable trust protect your assets from nursing homes. Thats because although the trust is a legal entity for legal purposes youre treated as the owner of the trust assets. Please make sure your loved ones are not letting their current planning documents gather dust thinking all is well when they may fall victim to this unfortunate misconception. You will not be able to obtain principal from your irrevocable trust but any dividends and interest you receive from the irrevocable trust do.

The other issue though involves Medicaid. A revocable trust does protect your assets in one important way. If you want to review planning opportunities for potential future nursing home or.

This question comes up regularly in conversation with a wide range of people. This means you could end up paying for a nursing home out of pocket since Medicaid is one of the few insurance providers which pays for nursing home care. A revocable living trust cant reliably protect your assets although an irrevocable trust can but forming an irrevocable trust means giving up control and ownership of your assets forever.

In that case assets that have been transferred into the right type of irrevocable trust are typically safe from all creditors. An irrevocable trust can protect your assets against Medicaid estate recovery. You can place property in take it back out sell it or.

It will not protect your assets from debt. Why Creditors Can Get to Assets in a Revocable Living Trust Revocable living trusts dont however protect your assets from people with legal claims against you. Fact or Fiction.

When the nursing home bills the patient the facility has all the same recourses as any creditor when trying to collect a debt. When you or your spouse if they are part of the trust pass away any assets put into an irrevocable trust are not included in the estate for the calculation of Medicaid recovery the estate tax or probate. When created for the purpose of protecting assets from being used for nursing home or other long-term care costs the term Medicaid trust may be used to describe this type of irrevocable trust.

We have assisted clients to protect assets and qualify for Medicaid even after years of private paying the nursing home expenses. Unfortunately living trusts also called revocable trusts or revocable living trusts do not protect assets if you need long-term care. To shield your assets from the spend-down before you qualify for Medicaid you will need to create an irrevocable trust.

A revocable living trust does not protect your savings from the cost of a nursing home.

Does a revocable trust protect your assets from nursing homes A revocable living trust does not protect your savings from the cost of a nursing home.

Does a revocable trust protect your assets from nursing homes. To shield your assets from the spend-down before you qualify for Medicaid you will need to create an irrevocable trust. Unfortunately living trusts also called revocable trusts or revocable living trusts do not protect assets if you need long-term care. We have assisted clients to protect assets and qualify for Medicaid even after years of private paying the nursing home expenses. When created for the purpose of protecting assets from being used for nursing home or other long-term care costs the term Medicaid trust may be used to describe this type of irrevocable trust. When you or your spouse if they are part of the trust pass away any assets put into an irrevocable trust are not included in the estate for the calculation of Medicaid recovery the estate tax or probate. When the nursing home bills the patient the facility has all the same recourses as any creditor when trying to collect a debt. Fact or Fiction. Why Creditors Can Get to Assets in a Revocable Living Trust Revocable living trusts dont however protect your assets from people with legal claims against you. It will not protect your assets from debt. You can place property in take it back out sell it or. An irrevocable trust can protect your assets against Medicaid estate recovery.

In that case assets that have been transferred into the right type of irrevocable trust are typically safe from all creditors. A revocable living trust cant reliably protect your assets although an irrevocable trust can but forming an irrevocable trust means giving up control and ownership of your assets forever. Does a revocable trust protect your assets from nursing homes This means you could end up paying for a nursing home out of pocket since Medicaid is one of the few insurance providers which pays for nursing home care. This question comes up regularly in conversation with a wide range of people. If you want to review planning opportunities for potential future nursing home or. A revocable trust does protect your assets in one important way. The other issue though involves Medicaid. You will not be able to obtain principal from your irrevocable trust but any dividends and interest you receive from the irrevocable trust do. Please make sure your loved ones are not letting their current planning documents gather dust thinking all is well when they may fall victim to this unfortunate misconception. Thats because although the trust is a legal entity for legal purposes youre treated as the owner of the trust assets.

Does A Revocable Living Trust Protect Assets From Nursing Homes Homelooker

Does A Revocable Living Trust Protect Assets From Nursing Homes Homelooker