27++ How Do I Know The Status Of My Tax Return information

How do i know the status of my tax return. If youll receive a notice in the mail as with stimulus. Call the IRS Refund Hotline You may check the status of your expected tax refund by calling the IRS Refund Hotline at 800-829-1954. The IRS began accepting and processing 2020 tax year returns on Friday February 12 2021. Using the IRS Wheres My Refund tool Viewing your IRS account information. Check the Status of Your Income Tax Refunds. Treasury last week estimated that as of early March 73 million people who filed 2020 tax returns qualified for a provision. You can check the status of your refund online by using our Wheres My Refund. Since e-filed state returns are first sent to the IRS we ask that you consider and recognize this adjustment to the processing timeline for the 2020 tax. In order to view status information you can visit our website at TaxWVGov and click on the Wheres My Refund banner at the top of the page. You can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021. Your filing status is used to determine your filing requirements standard deduction eligibility for certain credits and your correct tax. 9 key things to know.

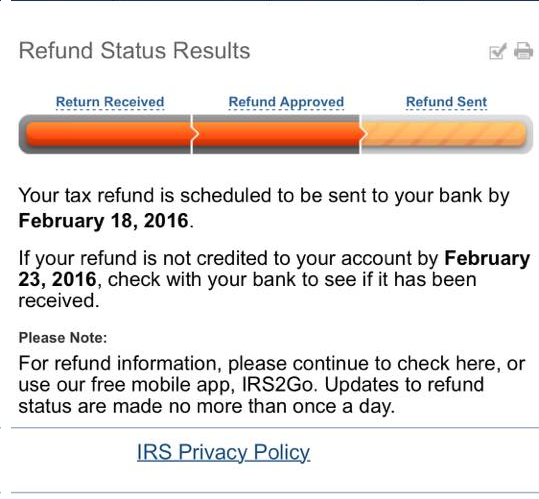

To track the status of your tax refund you need several things on hand. Your Social Security number or Individual Taxpayer Identification Number your filing status -- single married or head of. After the 8-week timeline taxpayers can inquire about their returns by calling 602 255-3381 or if calling from area codes 520 or 928 they can call toll-free to 800 352-4090. Youll also receive an e-mail confirmation directly from the IRS. How do i know the status of my tax return If your 2020 tax return status filed in 2021 is still being processed after you have filed your return the IRS has confirmed that they are backlogged on processing and issuing refunds. To follow the status of your tax return you can check the latest information on the North Carolina Department of Revenue website. Once the IRS receives your return your e-file status is accepted. If youll be able to track it with the IRS Get My Payment tool or some other portal. You can file your tax return by mail through an e-filing website or software or by using the services of a tax preparer. It will tell you when your return is in received status and if your refund is in approved or sent status. This means the IRS didnt spot anything missing and theres nothing more for you to do right now. For paper filed returns taxpayers should allow 8 weeks from the date filed before calling to check on the status of a return. Do not file a second tax return.

Where S My State Tax Refund Updated For 2020 Smartasset

Where S My State Tax Refund Updated For 2020 Smartasset

How do i know the status of my tax return The IRS releases most refunds within 21 calendar days after the e-filed return has been accepted.

How do i know the status of my tax return. Once your return has been accepted and processed you can check its status with the IRS or your State. When will my return information be available. However if you mail a paper copy of your tax return the IRS recommends that you wait three weeks before you begin checking your refund status.

If you file in early January before the IRS begins accepting returns your e-file status can remain pending for a few weeks. Wheres My Refund tells you to contact the IRS. If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted by the IRS.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. A report from the US. The Wheres My Refund tool located at httpswwwirsgovrefunds follows your tax return from receipt to completion.

Report and Verify Your Taxes. In what form the unemployment refund will arrive. The IRS started disbursing unemployment refunds to taxpayers who paid taxes on the benefit payments treating it.

This automated system will provide your refund status if you supply your Social Security number filing status and refund amount due. If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax. On-Line Taxes can assist you with the status of your tax return however we do not know the status of your refund from the IRS or your State.

Unemployment tax refund. Once you submit your return with OnLine Taxes you will need to check your status in. This will take you to another page where you will be prompted to enter the first social security number listed on your tax return along with the exact.

How do i know the status of my tax return This will take you to another page where you will be prompted to enter the first social security number listed on your tax return along with the exact.

How do i know the status of my tax return. Once you submit your return with OnLine Taxes you will need to check your status in. Unemployment tax refund. On-Line Taxes can assist you with the status of your tax return however we do not know the status of your refund from the IRS or your State. If more than one filing status applies to you this interview will choose the one that will result in the lowest amount of tax. This automated system will provide your refund status if you supply your Social Security number filing status and refund amount due. The IRS started disbursing unemployment refunds to taxpayers who paid taxes on the benefit payments treating it. In what form the unemployment refund will arrive. Report and Verify Your Taxes. The Wheres My Refund tool located at httpswwwirsgovrefunds follows your tax return from receipt to completion. A report from the US. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted by the IRS. Wheres My Refund tells you to contact the IRS. How do i know the status of my tax return If you file in early January before the IRS begins accepting returns your e-file status can remain pending for a few weeks. However if you mail a paper copy of your tax return the IRS recommends that you wait three weeks before you begin checking your refund status. When will my return information be available. Once your return has been accepted and processed you can check its status with the IRS or your State.

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting