30++ How Do I Apply For Tax Exempt Status In Alabama ideas

How do i apply for tax exempt status in alabama. If your Alabama Taxes. Individual Tax Return Form 1040 Instructions. If a refund is preferred Form ITRE-2WH Application for Refund of Income Tax Withholding can be obtained by submitting a written request to the Department. CLICK HERE or enter httprevenuealabamagovadvaloremcountyofficesindexcfm in your internet browser. Totally exempted from all taxes. How do I contact the Alabama Department of Revenue. A single exemption can apply to multiple organizations such as all of the organizations funded by a United Way agency. Instructions for Form 1040 Form W-9. To print an application form click here or you can request an application form from the Status. SELECT ONE OF THE FOLLOWING. Anyone with a sales tax account and registered on MAT may also log in to their MAT account and choose the option to verify a sales tax account or direct pay permit. The Alabama Jobs Act Sections 40-18-376 allows an Approved Company that has been awarded an Investment Credit to utilize the credit against certain utility taxes.

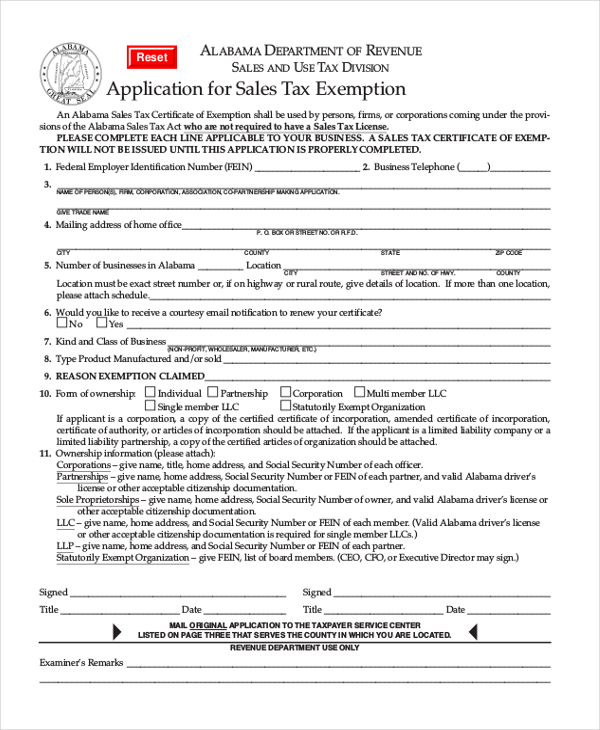

A Membership can be created online but applying for Tax Exempt status can only be completed by emailing the Sales Tax Operations Team or at the Club. Request for Transcript of Tax. This property tax exemption is documented at Code of Alabama 1975 40-9-21. If you qualify as tax-exempt the IRS will send you a Letter of Determination. How do i apply for tax exempt status in alabama The Alabama Department of Revenue has released an updated list of charitable organizations that are exempt from paying the state sales and use tax pursuant to special acts of the Legislature. If you need a copy of your license you can print a copy from your My Alabama Taxes account or contact the Business Registration Unit at 334 242-1584. In Alabama certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. You need to apply for the exemption through your county tax assessors office. Please follow the instructions carefully to ensure all pertinent information and supporting documentation are supplied. Some common items which are considered to be exempt are. Heres a link to every county. For more information please refer to the Form 1023 product page. Section 1 must be completed by all institutions.

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

How do i apply for tax exempt status in alabama Several organizations were added to this on August 1 2012.

How do i apply for tax exempt status in alabama. Credit Against Utility Taxes Paid for Certain Approved Companies. A sales tax license can be obtained by registering through the My Alabama Taxes website. A person who qualifies for the exemption is not required to renew the request for exemption after the initial qualification but can simply verify the continuing disability by mailing in a form provided from the Tax AssessorRevenue Commissioner.

How to use sales tax exemption certificates in Alabama. You can file for 501c3 tax-exempt status with the IRS by submitting Form 1023 the Application for Recognition of Exemption. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want.

Information needed to register includes. Alabama Association of Rescue Squads Incorporated. As of January 31 the IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov.

How to register for a sales tax license in Alabama. Alabama Department of Revenue 50 North Ripley Street Montgomery AL. 228 for sales taxes 178 for use taxes and 56 for lodging taxes.

Prescription drugs gasoline and motor oil items seeds which are intended for planting purposes fertilizerinsecticidesfungicides agricultural feed for livestock and livestock. H-4 Adjusted Gross Income is greater than 12000 on their most recent State Income Tax Return taxpayer spouse combined. Please contact incentivescommercealabamagov for qualification inquiries under the Alabama Jobs Act.

If you are opening a business or other entity in that will have employees will operate as a Corporation or Partnership is required to file employment excise or Alcohol Tobacco and Firearms or is a Trust Estate or Non-profit organization you are required to obtain a Tax. Original ITRE-2WH forms are required and photocopies will not be accepted. ClaimValidate only once If income status changes and falls below the 12000 level you will need to.

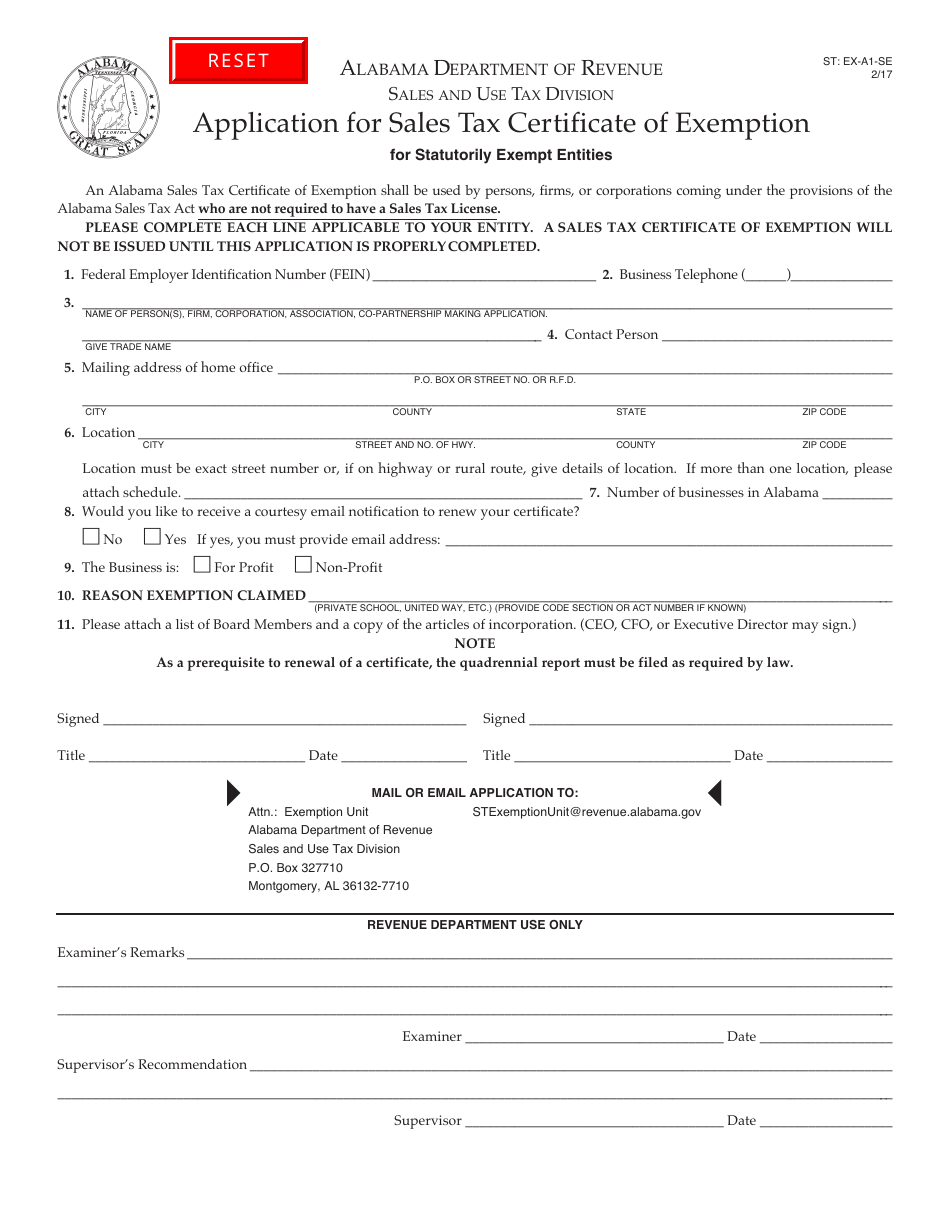

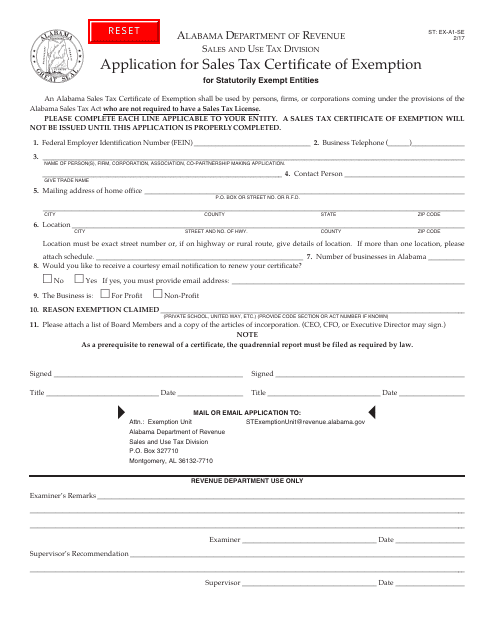

Institutions seeking exemption from sales and use tax must complete this application. Employers should submit an application as soon as liability has been established. Type of business entity.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. In Alabama 462 exemptions currently are granted by state statute. Items ordered online can be selected as Tax Exempt on the shipping page while completing the checkout process after exemption has.

Application for a Tax ID EIN in Alabama. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. This link explains the process.

Is my nonprofit exempt from Alabama Corporate Income Tax. Sole Proprietorship Partnership Corporation Limited Liability Company LLC Entity name. You can open an Alabama Unemployment Tax account by completing an application Form SR-2.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. All sections of the application must be completed in black ink. Refunds generally take anywhere from 10 to 12 weeks.

How do i apply for tax exempt status in alabama Refunds generally take anywhere from 10 to 12 weeks.

How do i apply for tax exempt status in alabama. All sections of the application must be completed in black ink. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. You can open an Alabama Unemployment Tax account by completing an application Form SR-2. Sole Proprietorship Partnership Corporation Limited Liability Company LLC Entity name. Is my nonprofit exempt from Alabama Corporate Income Tax. This link explains the process. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Application for a Tax ID EIN in Alabama. Items ordered online can be selected as Tax Exempt on the shipping page while completing the checkout process after exemption has. In Alabama 462 exemptions currently are granted by state statute. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Type of business entity. Employers should submit an application as soon as liability has been established. How do i apply for tax exempt status in alabama Institutions seeking exemption from sales and use tax must complete this application. ClaimValidate only once If income status changes and falls below the 12000 level you will need to. Original ITRE-2WH forms are required and photocopies will not be accepted. If you are opening a business or other entity in that will have employees will operate as a Corporation or Partnership is required to file employment excise or Alcohol Tobacco and Firearms or is a Trust Estate or Non-profit organization you are required to obtain a Tax. Please contact incentivescommercealabamagov for qualification inquiries under the Alabama Jobs Act. H-4 Adjusted Gross Income is greater than 12000 on their most recent State Income Tax Return taxpayer spouse combined. Prescription drugs gasoline and motor oil items seeds which are intended for planting purposes fertilizerinsecticidesfungicides agricultural feed for livestock and livestock. 228 for sales taxes 178 for use taxes and 56 for lodging taxes. Alabama Department of Revenue 50 North Ripley Street Montgomery AL.

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

How to register for a sales tax license in Alabama. As of January 31 the IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov. Alabama Association of Rescue Squads Incorporated. Information needed to register includes. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. You can file for 501c3 tax-exempt status with the IRS by submitting Form 1023 the Application for Recognition of Exemption. How to use sales tax exemption certificates in Alabama. A person who qualifies for the exemption is not required to renew the request for exemption after the initial qualification but can simply verify the continuing disability by mailing in a form provided from the Tax AssessorRevenue Commissioner. A sales tax license can be obtained by registering through the My Alabama Taxes website. Credit Against Utility Taxes Paid for Certain Approved Companies. How do i apply for tax exempt status in alabama.